Convenient

Experience fast and effortless access - only one document needed.

Experience fast and effortless access - only one document needed.

Count on us as your reliable direct lender - we support you whenever.

Enjoy a simple and swift solution from the comfort of your home.

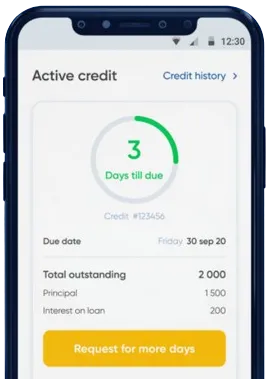

Submit your loan request effortlessly by completing the simple form within our app.

Receive our prompt decision, typically provided within just 15 minutes.

Have your funds transferred to your account swiftly, usually within one minute of approval.

In today's fast-paced world, quick access to credit is indispensable, especially for addressing urgent expenses. With the advent of the loan app on iPhone, financial solutions are now more accessible than ever. These apps empower users by offering seamless, efficient borrowing experiences directly from their smartphones, simplifying the process of obtaining funds for both personal and business needs. The convenience of accessing loans anytime and anywhere has made these apps increasingly popular, especially among individuals who value speed and flexibility.

Moreover, the streamlined application processes eliminate the need for traditional paperwork, saving users time and hassle. Whether you're dealing with an unexpected emergency or planning a large purchase, these apps ensure that financial assistance is just a few clicks away.

The loan app for iPhone has revolutionized the way individuals approach borrowing. Traditional methods often involve lengthy processes, while these apps provide near-instant approvals, paperless transactions, and user-friendly interfaces. Users no longer need to visit physical branches or endure long wait times for loan approvals. Instead, they can complete the entire process from the comfort of their homes. Additionally, the intuitive design of these apps ensures that even first-time users can navigate the application process with ease. Whether you're consolidating debt or managing an emergency, these apps ensure you have financial support at your fingertips, providing a new level of convenience and accessibility in personal finance.

When time is of the essence, the instant loan app for iPhone offers unparalleled speed and efficiency. Users can apply for loans and receive funds directly into their accounts in minutes. This rapid response is ideal for tackling unexpected costs like medical emergencies or urgent repairs, ensuring you’re never left in a financial bind. The process is designed to prioritize speed without compromising security, ensuring users can rely on these apps even in high-pressure situations. Furthermore, instant loan apps often feature competitive interest rates, making them a cost-effective option for short-term financial needs. With their streamlined approach, these apps are redefining what it means to access credit in today’s fast-moving world.

Loan apps for iPhone provide tailored solutions for a variety of financial needs, whether it's covering daily expenses, funding a project, or bridging short-term gaps. With flexible repayment terms and inclusive lending criteria, these apps cater to a diverse audience, making credit more accessible to all. They are particularly useful for those who may not qualify for traditional loans due to limited credit histories or unique financial circumstances. Many of these apps also offer features like budget tracking and financial advice, empowering users to manage their money more effectively. By combining convenience with comprehensive services, loan apps for iPhone are helping users achieve financial stability and peace of mind.

Looking for an app to borrow money on iPhone? These platforms not only provide instant access to funds but also foster financial literacy by offering transparent terms and tools for managing repayments effectively. They eliminate the need for extensive documentation, making them a perfect choice for those in urgent need of credit. Additionally, these apps often include tools for tracking repayment schedules, helping users stay on top of their financial obligations. Some apps even reward timely repayments with improved loan terms or increased credit limits. Whether you're navigating a financial emergency or planning for future expenses, these apps provide a simple yet powerful solution for managing your financial needs.

For individuals in Nigeria, these apps are particularly valuable. The Nigeria loan app on iPhone stands out for its accessibility, offering solutions without requiring a biometric verification number (BVN). Features such as flexible repayment plans, inclusive credit assessments, and rapid approvals make these apps indispensable in the modern financial ecosystem. They cater to a wide demographic, including students, entrepreneurs, and salaried employees, ensuring everyone has access to timely credit. Many apps also include localized features, such as language options and region-specific loan products, making them even more user-friendly. By addressing the unique needs of Nigerian users, these apps are playing a crucial role in driving financial inclusion across the country.

Whether it's a loan app without BVN in Nigeria on iPhone or a standard option, these platforms cater to a wide range of borrowers, ensuring that everyone has access to reliable financial support. From students to entrepreneurs, these apps bridge the gap between financial challenges and practical solutions. They also prioritize user security, employing advanced encryption and verification methods to protect sensitive information. This focus on security and reliability has made these apps a trusted resource for millions of Nigerians seeking financial assistance.

Other notable features include:

With the increasing adoption of digital finance, apps like the loan app for iPhone in Nigeria are redefining how people approach borrowing. Whether you’re seeking a loan app on iPhone in Nigeria or exploring options like the iPhone loan app in Nigeria, these tools ensure a streamlined, hassle-free experience. They combine modern technology with customer-centric services, creating a powerful tool for managing financial needs effectively.

The era of digital lending has arrived, and the loan apps on iPhone are leading the way. With their user-friendly platforms and innovative features, they have transformed financial access, making borrowing faster, simpler, and more inclusive. These apps are not just about convenience; they are about empowering users to take control of their financial futures. By offering flexible terms, quick approvals, and secure transactions, they provide a comprehensive solution for managing short-term financial needs.

Whether you need immediate funds or want to explore flexible credit options, these apps provide the support you need to navigate financial challenges with confidence. They are particularly valuable in countries like Nigeria, where traditional banking services may not be accessible to everyone. By bridging the gap between users and financial institutions, these apps are fostering greater financial inclusion and resilience. As the adoption of digital financial tools continues to grow, loan apps on iPhone are set to play an increasingly pivotal role in shaping the future of personal finance.

Yes, you can easily apply for a loan using dedicated loan apps available for iPhone. These apps are designed to provide users with a seamless and efficient way to access loans directly from their smartphones. The process typically involves downloading the app, registering your details, and applying for the desired loan amount. Most apps offer quick approvals, ensuring convenience for borrowers needing urgent financial assistance.

Most reputable loan apps available on iPhone in Nigeria are safe to use, as they employ advanced encryption and security measures to protect user data. However, it is essential to research and verify the credibility of the app before providing any personal or financial information. Look for apps with positive user reviews, transparent terms, and secure payment gateways. Ensuring the app is licensed and regulated further enhances your safety when borrowing through these platforms.

While requirements can vary depending on the loan app, there are common criteria that most platforms follow. These include a valid form of government-issued identification (such as a national ID or passport), proof of income (such as pay slips or bank statements), and an active Nigerian bank account. Some apps may also require phone number verification or additional documentation to assess your eligibility. Ensuring you have these documents ready can speed up the application process.

The time it takes to receive loan funds after approval can differ between apps. Most well-known loan apps transfer the money within minutes to a few hours, ensuring rapid access during emergencies. However, some platforms may take up to one or two business days depending on their verification and processing systems. Factors like the loan amount and bank processing times can also affect the speed of disbursement.

Yes, most loan apps include fees and charges as part of their lending terms. These can include processing fees, interest rates, and penalties for late repayment. It is vital to carefully read the terms and conditions provided by the app to understand the total cost of the loan before applying. Reputable apps provide transparent information about their charges, helping you make informed financial decisions.

If you are unable to repay a loan on time, you may incur late fees, penalties, or an increase in the interest rate. Additionally, failure to repay could negatively affect your credit score, impacting your ability to borrow in the future. Many loan apps offer repayment extensions or restructuring options, so it is advisable to contact the provider as soon as you anticipate difficulties. Open communication can help you avoid further complications and maintain a good financial standing.